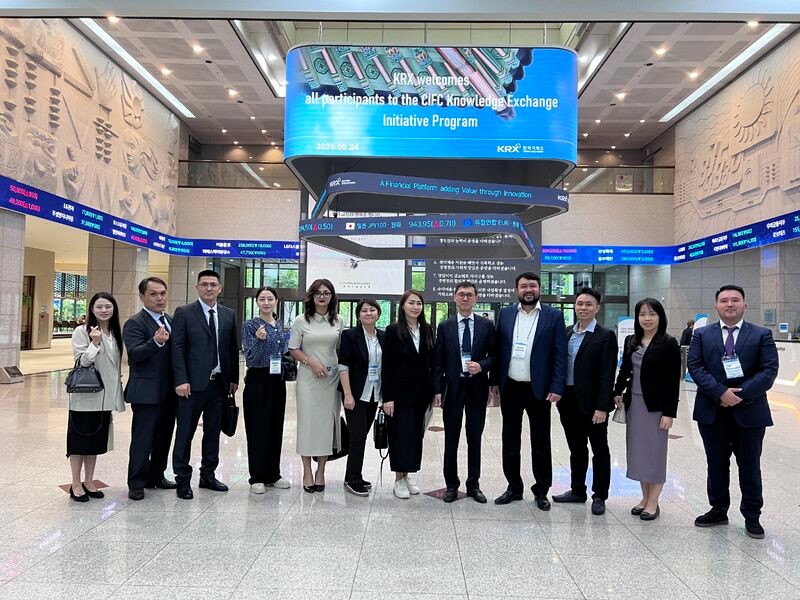

JSC Fund of Problem Loans participated in the Knowledge Exchange Initiative (KEI) Program at the Invitation of the Council on International Financial Cooperation (CIFC) in the Republic of Korea

Seoul, Republic of Korea, September 21–27, 2025

The KEI 2025 program was focused on studying the Republic of Korea’s experience in financial policy, capital markets, digital transformation, and the management of distressed assets. Lectures and discussions were delivered by leading institutions — Korea Institute of Finance (KIF), Korea Exchange (KRX), Korea Financial Investment Association (KOFIA), and Korea Asset Management Corporation (KAMCO)1.

The topics of the lectures and discussions covered the following areas:

1. Development of the Financial Sector and Regulation (KIF)

The lecture examined the stages of Korea’s economic and financial development: from the export-oriented industrialization of the 1960s to digitalization and sustainable growth. It covered key legislative acts and the structure of regulatory bodies (FSC, FSS), as well as policies for consumer protection (Financial Consumer Protection Act, 2020). For the first time at the legislative level, consumer rights were enshrined, including access to information, data protection, and the right to compensation. More than 76 laws and around 40 regulatory bodies are involved in oversight, creating a complex but flexible system.

Special attention was given to financial literacy and the digital transformation of the sector, including the regulation of fintech, crypto-assets, and “Buy Now Pay Later” services. The government regularly conducts surveys and designs programs for vulnerable groups, including pensioners and rural populations. Korea also implements the “one company – one school” initiative, under which banks and investment companies are assigned to schools to provide financial education to children.

Thus, the Korean experience highlights the importance of a comprehensive regulatory framework and coordinated supervision in ensuring the sustainable development of the financial sector. These approaches could be valuable for Kazakhstan in improving regulation, protecting consumer interests, and enhancing financial literacy.

2. Government Bond Market and Debt Instruments (KIF)

The lecture provided an overview of the evolution of Korea’s government bond market, from the first issuance in 1950 to modern innovative instruments. The main focus was on Korea Treasury Bonds (KTB), which serve as a benchmark for the entire financial market. Key mechanisms included regular auctions with transparent rules, the BOK-Wire+ digital platform for submitting bids and recording transactions, and the separation of primary and secondary markets (exchange-traded KRX and OTC).

Foreign investor participation was highlighted, with their share in KTB reaching a record 22.8% in 2024, compared to around 6–7% in Kazakhstan. Foreign investors provide liquidity and diversification, reducing volatility risks.

New instruments included Korea Savings Bonds (KSB), first issued in 2024 and available only to individuals, offering guaranteed capital repayment to encourage long-term household savings. The development of ETFs on KTB and STRIPS, which allow separation of coupon payments and principal, was also highlighted as a way to increase investor flexibility. Korea has also introduced a “trader error correction mechanism” (since 2020), enabling the cancellation of large erroneous trades, boosting confidence in the exchange system.

Thus, Korea’s experience demonstrates the importance of predictable issuance policy and broad investor participation. Approaches such as “people’s bonds” and the use of ETFs and STRIPS could be considered by Kazakhstan in developing its domestic debt market.

3. Digitalization of Financial Services (KIF)

The lecture addressed Korea’s digital transformation and the transition from traditional operations to platform-based services such as Open Banking, MyData, and digital assets.

It was noted that account ownership in Korea reaches 99%, while over 97% of adults use smartphones, in cluding 85% of those over 70, ensuring near-universal digital inclusion. Kazakhstan also shows high levels of digitalization through mobile banking.

Open Banking in Korea covers 37 million users and more than 226 million accounts, allowing customers to manage finances through a single interface and make interbank transfers without visiting branches. Kazakhstan’s initiatives remain in early stages. Similarly, MyData services are widely used in Korea to compare loans, deposits, and insurance products, as well as optimize debt, while Kazakhstan is only beginning to introduce such services.

A major milestone was the adoption of the Virtual Asset User Protection Act (2023/2024), Korea’s first law regulating virtual assets, designed to protect users and prevent abuse. In 2024, the average daily trading volume of virtual assets reached KRW 18.1 trillion, more than double KOSPI’s stock market turnover. Kazakhstan took a similar step with the Law on Digital Assets (February 6, 2023), regulating issuance, circulation, mining, and exchanges, aligning national practice with international standards.

Korea has also developed a large fintech ecosystem with over 600 companies. In Kazakhstan, by 2024, Astana Hub reported 200 fintech startups, while more than 4,000 companies, including licensed digital asset exchanges, operate through the AIFC.

Thus, Korea’s digitalization is built on strong ICT infrastructure, large-scale Open Banking and MyData services, and specialized regulation of digital assets. Kazakhstan is also progressing strongly, with 85.9% cashless payments, over 24 million mobile banking users, and its own digital asset law. However, open finance and MyData remain under development.

4. Development of Capital Markets and the Role of KRX

The lecture highlighted the Korea Exchange (KRX), showing how it evolved from its first trading platform in 1956 to an integrated structure in 2005. Today, KRX includes KOSPI (large firms), KOSDAQ (SMEs and innovators), and KONEX (startups). By 2025, market capitalization reached USD 16.8 trillion with over 2,500 listed companies.

Retail investors dominate, accounting for 66% of trades on KOSPI and 89% on KOSDAQ, ensuring liquidity and dynamism. In Kazakhstan, the retail segment remains limited, with institutions leading activity.

KRX also expands internationally, exporting IT solutions and supporting exchanges in Laos, Cambodia, Vietnam, Uzbekistan, and the Philippines. Recent innovations include Nextrade (2025), an alternative trading system with extended hours and lower fees, and overnight derivatives trading via CME Globex and EUREX.

Thus, KRX’s experience shows how integration, infrastructure development, and international cooperation build a competitive financial center. Kazakhstan could apply these lessons to develop AIX as a regional hub.

5. The Role of KOFIA and Self-Regulation

The lecture presented the Korea Financial Investment Association (KOFIA) as a key self-regulatory body, uniting over 580 members (brokers, asset managers, rating agencies, investment firms). KOFIA conducts inspections, approves product advertisements, resolves disputes, and manages investor protection centers.

Over 20,000 professionals take KOFIA exams annually. It has also advocated for lower transaction taxes, introduced pension reforms (“default options”), and developed IT training tools.

Kazakhstan also has self-regulation elements but less centralized. The Korean model shows that self-regulation improves transparency, reduces regulator burden, and strengthens investor trust.

6. KAMCO’s Experience in NPL Management

The lecture focused on Korea Asset Management Corporation (KAMCO), created in 1997 after the Asian Financial Crisis. KAMCO purchased large volumes of NPLs, financed via government bonds and securitization, and introduced restructuring programs, securitization, and electronic platforms like OnBid. This cleaned bank balance sheets and created a secondary NPL market, though initially with high fiscal costs and public criticism. Over time, sales, digitalization, and private investment improved efficiency and reputation.

Thus, KAMCO demonstrates how public AMCs stabilize financial systems but require strong governance. For Kazakhstan, lessons include expanding e-platforms, adopting NPL securitization, and strengthening the legal base.

Conclusion

The KEI program gathered government, financial, and international representatives across Asia. Kazakhstan was represented by Fund of Problem Loans JSC and the Ministry of Finance.

On behalf of the Fund of Problem Loans JSC, Deputy Chairman Mr. Nurzhan Baigaziyev presented an overview of Kazakhstan’s economy, capital markets, banking sector, AIX development, digital assets, retail investor growth, and NPL platforms DMAS and Debex.

Participation enabled exchange with partners, learning from Korea, and presenting Kazakhstan’s achievements. The KEI program fostered knowledge exchange, networking, and cooperation prospects.

- Korea Institute of Finance (KIF). A national research center in the field of finance, established to conduct academic research and analysis. It advises the government and regulators, develops recommendations on the development of financial markets, the banking sector, and regulation.

Korea Exchange (KRX). The national stock exchange of the Republic of Korea, combining equity markets (KOSPI, KOSDAQ, KONEX), bonds, and derivatives. It serves as the key platform for company listings, capital raising, and international investment. KRX actively develops IT infrastructure and exports its solutions to other countries.

Korea Financial Investment Association (KOFIA). A self-regulatory organization uniting participants of the financial market: brokers, asset management companies, rating agencies, trust and investment firms. It sets business standards, conducts exams and certification of professionals, protects investors’ rights, and promotes educational initiatives.

Korea Asset Management Corporation (KAMCO). A state-owned corporation for managing distressed assets and non-performing loans (NPL), established after the 1997 Asian financial crisis. It specializes in purchasing, restructuring, and selling NPLs, as well as developing electronic platforms for their trading. KAMCO is considered one of the benchmark examples of a successful AMC in Asia. ↩︎