The Fund of Problem Loans and the Asset Management Corporation of Mongolia signed a Memorandum of Understanding

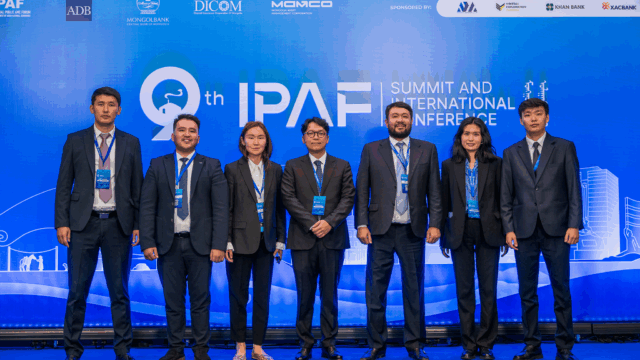

Within the framework of the 9th Summit and the International IPAF Conference (International Public Asset Management Company Forum), held on August 13 in Ulaanbaatar (Mongolia), a bilateral meeting took place between JSC “Fund of Problem Loans” (FPL) and the Asset Management Corporation of Mongolia (Mongolia Asset Management Corporation or MAMCO) — the hosting side of the Summit and the International IPAF Conference this year.

As a result of the meeting, the parties signed a Memorandum of Understanding, providing for the development of cooperation and exchange of experience in the field of management of distressed assets.

The document secures the intention of the parties to conduct regular consultations, share practical experience and information about the applied approaches to management of distressed portfolio, as well as to consider possibilities of joint initiatives in the interests of both organizations.

The conclusion of the Memorandum became yet another step in strengthening the international ties of the Fund, which will allow more effectively to solve the tasks set by the state on rehabilitation of the banking sector and involvement of non-performing assets into economic circulation.

It is worth noting that the signed document has already become the third in a row international agreement of the Fund. Earlier memorandums of understanding were concluded with the Korean Asset Management Corporation (KAMCO) and the National Asset Management Agency of Ireland (NAMA). This allows the Fund to remain aware of the latest trends, to receive direct access to expert assessments, and to increase the qualification of specialists.

The Fund is open to cooperation with international financial organizations and companies in the sphere of management of distressed assets, which corresponds to the tasks of the Concept of development of the financial sector of the Republic of Kazakhstan until 2030. In this context, special significance has the upcoming 10th Summit and International IPAF Conference, which in 2026 will take place in Kazakhstan with the organizational role of the Fund jointly with the Asian Development Bank.

For our country this is a unique opportunity to strengthen the image of Kazakhstan as a reliable participant of the international financial community and to expand competences in the sphere of ensuring financial stability, since IPAF is one of the key international platforms for elaboration of solutions and exchange of experience in the field of distressed asset management.

Active participation of the Fund in the events and initiatives of IPAF will allow not only to receive access to advanced practices and know-how of foreign colleagues in the sphere of settlement of problem loans, but also to present to the international community own solutions and results. In this way Kazakhstan confirms readiness to be not just a participant, but a full-fledged partner in formation of the global agenda on distressed asset management and strengthens its positions on the international financial arena.