VIETNAM’S EXPERIENCE IN NPL RESOLUTION

Updated data and regulatory developments as of 2025.

Background of VAMC Establishment

- Development of the banking system since the 1990s: diversification (state-owned, private, and foreign banks).

- First NPL surges after 2008: deterioration in portfolio quality and bankruptcies of major borrowers.

- Issues: imperfect legal framework and lack of accounting standardization.

- In recent years, a sharp increase in NPLs has been observed (especially in 2023 after revaluation and restructuring).

- As of 2024, the systemic NPL level remains above pre-crisis levels.

Establishment of VAMC and Its Tools

- Established by decision of the State Bank of Vietnam on June 27, 2013; 100% state-owned; initial capital — 500 billion VND.

- Main funding sources: charter capital and special bonds.

- Mission: acquisition and resolution of NPLs, debt restructuring.

- Mechanisms: purchases using special bonds (nominal minus reserves) and market-based acquisitions for active management.

- VAMC coordinates judicial recovery, auctions, and restructuring.

Asset Purchase and Management Results (Up to 2019)

- 2013–2017: over 26,000 loans (~17,000 borrowers); total debt ≈ $14 billion, purchase price $12.7 billion.

- By end-2019: NPLs with total debt of $16.3 billion were acquired at $14.9 billion; recovery rate ~73.8%.

- 2017–2019 (market-based purchases): NPLs worth $350 million acquired for $357 million; recovery rate 64.6%.

- Limitations: most purchases were through bond swaps (technical nature); legal challenges in enforcement.

Performance Indicators and Trends (2021–2024)

- 2023: on-balance NPLs reached 5.9% (September 2023, according to some estimates).

- 2024: ADB estimated NPLs at ~5.4% (total NPL volume $31.39 billion).

- After 2021–2022 (official NPLs <2%), 2023–2024 saw growth due to restructuring and revaluation of loans.

- The State Bank of Vietnam introduced Circular 03/2024 to improve bad-debt trading regulations.

Regulatory Developments (2024–2025)

- Circular 03/2024/TT-NHNN (effective July 1, 2024): updated rules for bad-debt trading and settlements; simplified procedures between VAMC and banks.

- Amendments to the Law on Credit Institutions (2024–2025) aimed to accelerate enforcement and expand the powers of banks and VAMC.

- 2025 Initiatives: allowed higher foreign ownership (up to 49% for some banks), revised credit growth limits from 2026 onward.

Limitations and Recommendations

Challenges:

- A significant share of NPLs remains on banks’ balance sheets.

- Insufficient judicial and administrative support for recoveries.

- Weak collateral database.

- VAMC still limited in market-based acquisitions.

Recommendations:

- Strengthen the legal framework for easier collateral enforcement.

- Develop the distressed asset market and attract private investors.

- Improve transparency and data sharing (single collateral registry and NPL database).

Sources and Analytical Base

- ADB — Nonperforming Loans Watch in Asia 2025 (NPL estimate for 2024: ~5.4%).

- IMF — Vietnam: 2025 Article IV Consultation (NPL data for 2023–2024).

- State Bank of Vietnam — Circular 03/2024/TT-NHNN (bad-debt trading regulations).

- Amendments to the Law on Credit Institutions (2024–2025).

- VAMC analytical materials and research (2020–2025).

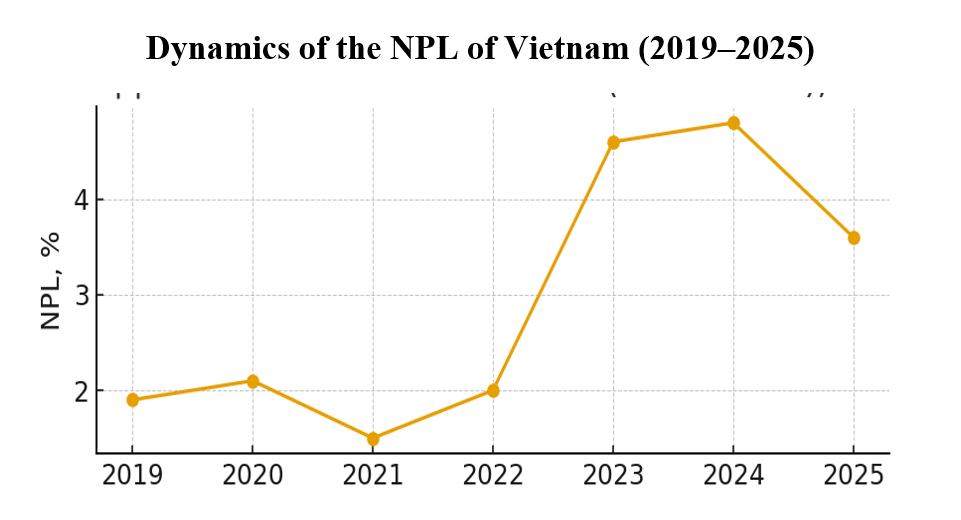

Analysis of Vietnam’s NPL Market Dynamics (2019–2025)

This analytical overview presents the dynamics of NPL indicators in Vietnam’s banking system from 2019 to 2025, considering macroeconomic trends, regulatory measures, and market data.

NPL Dynamics (2019–2025)

According to data from the State Bank of Vietnam (SBV), as well as CEIC and AMRO estimates, NPL levels showed the following trends:

After falling to a minimum of around 1.5% in 2021, they rose to 4.6–4.9% in 2022–2023.

In 2024, the figure was about 4.8%, and by 2025, it is estimated at around 3.6%, reflecting gradual sectoral improvement.

Dynamics of the NPL indicator in the banking system of Vietnam (2019–2025)

Key Factors Influencing NPL Levels

Major drivers of NPL growth and subsequent decline:

- Impact of the COVID-19 pandemic, which worsened loan portfolio quality.

- Rising debt in construction and real estate sectors.

- Revised accounting methodology revealing previously hidden bad assets.

- Strengthened regulatory measures and debt restructuring programs.

Regulatory Initiatives and Stabilization Measures

Circular 03/2024/TT-NHNN (Effective 2024)

- Updated VAMC’s operational framework and bad-asset trading rules.

- VAMC may now only acquire NPLs with recoverable potential or realizable collateral.

- Mandatory engagement of valuation firms to determine fair market value before purchase.

- A pre-acquisition action plan is required, outlining debt and collateral management strategies.

- Collateral can be sold flexibly — even above or below principal — if properly documented.

- Improved NPL trading procedures and accountability for liquidity and recovery assessments.

Result: Circular 03/2024 strengthens legal and financial standards for transactions and enhances the quality of bad-debt portfolio management.

Amendments to the Law on Credit Institutions (2024–2025)

- Accelerated enforcement and collateral realization procedures.

- Credit institutions may now enforce collateral based on contractual terms and borrower notification.

- Introduced early intervention and supervision for troubled institutions.

- Simplified liquidation and bankruptcy processes for credit institutions.

- Set new credit concentration limits (10–15% of capital by 2029).

- Clarified that income from NPLs cannot include assumed or unverified interest.

Effect: These amendments reinforce the legal foundation for NPL management and reduce systemic risk.

The State Bank of Vietnam has set an NPL target of below 3% by the end of 2025.

Structure and indicators by sectors (assessment)

Sector | NPL Level (2025, est. %)

| Recovery rate (est. %) |

Commercial Real Estate | 3–8 | 30–60 |

Residential Development | 4–10 | 20–50 |

Manufacturing | 1–5 | 40–70 |

Trade / Logistics | 1–5 | 35–65 |

Tourism / Hospitality | 4–10 | 20–45 |

Market Trends and Conclusions

The Vietnamese NPL market in 2024–2025 is characterized by gradual recovery driven by regulatory actions and banks’ adaptive strategies.

Focus has shifted toward sale and restructuring of distressed assets through VAMC and private platforms.

Enforcement efficiency is improving through a balanced mix of soft and legal approaches, resulting in higher asset recovery ratios.

Practical Recommendations

- When analyzing NPL portfolios, prioritize the legal clarity of collateral and debt structures.

- The most promising investment assets are those with verified collateral and commercial liquidity.

- To enhance effectiveness, cooperate with local asset management companies (VAMC, ARCs) and leverage Circular 03/2024 mechanisms.

- Continue monitoring legal and regulatory updates affecting recovery and asset sale procedures.

Final Conclusions

Vietnam’s NPL ratio shows a consistent downward trend following the 2023 peak.

The asset market is gradually regaining liquidity, while government measures create favorable conditions for faster resolution of distressed loans.

As Vietnam’s financial sector stabilizes, opportunities emerge for institutional investors to participate in NPL acquisition and restructuring programs.